Recommended Blogs

Why is Legacy Modernization Essential in the Insurance Industry?

Table of Contents

- What is Legacy Modernization?

- Why is Legacy Modernization in Insurance Important?

- Factors to Consider for Legacy App Modernization

- Benefits of Legacy Modernization in Insurance

- Conclusion

- Why Choose TestingXperts for Legacy Modernization in Insurance?

Legacy modernization is becoming crucial in the insurance industry due to various technological advancements. It includes introducing Gen-AI for improving CX, using cloud technologies to upscale service proficiency, and much more. These advancements are having a great impact on legacy systems as they are facing difficulties in meeting the evolving technological and customer demands. Insurance companies face various challenges when it comes to modernizing legacy systems. These challenges could range from difficulty in adopting remote workforce models to migrating from legacy to modern systems. There are also risks related to security and compliance with new regulatory requirements.

When discussing the strategic modernization approach, insurance companies are migrating their applications to cloud-native platforms. The idea is to adopt an enterprise-wide agile operational model. These strategies focus on improving faster time-to-market, having a secure service platform, enhancing business agility, and ensuring better CX. To address the security, compliance, and migration issues and remain competitive in the digital insurance environment, businesses should modernize their legacy systems. It involves technological upgrades, transforming existing operational models, and changing organizational mindsets.

What is Legacy Modernization?

Legacy modernization is a process of updating and transforming outdated software systems into modern systems. The process involves replacing or upgrading old systems to the latest, efficient, and customizable tech solutions. The goal is to reduce IT environment cost and complexity, enable platform collaboration, increase data consistency, and improve process flexibility.

It transforms existing systems into web-based client systems and facilitates the integration of multiple related systems. One particular challenge business mostly face in this process is ensuring a modernized system functions in sync with existing data formats. Legacy modernization benefits include staying competitive in the digital world, allowing businesses to offer better services, and providing a satisfying CX.

Why is Legacy Modernization in Insurance Important?

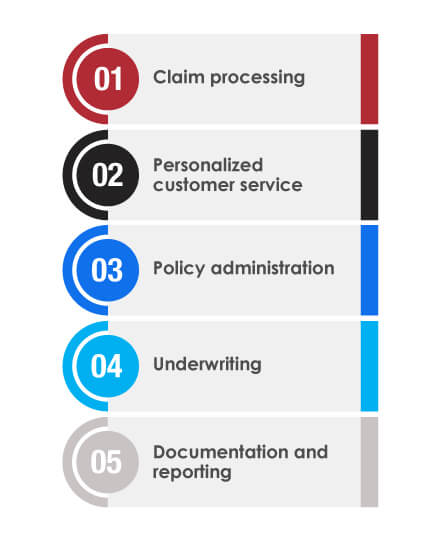

Legacy modernization or legacy app modernization in the insurance industry is necessary for several reasons. Firstly, it improves operational efficiency as outdated systems struggle with flexibility and processing speed. By modernizing outdated systems, insurance companies can streamline business processes and optimize the time and effort needed for tasks like:

• Claim processing

• Personalized customer service

• Policy administration

• Underwriting

• Documentation and reporting

This leads to cost savings, and speed enhancements as modern systems require less maintenance and resources to operate. Another reason for legacy modernization is to improve CX. In the current digital environment, consumers expect quick, easy, and accessible services. Legacy systems have limited capabilities that fail to meet expectations. Modern systems, in comparison, offer features like real-time claims tracking, personalized customer interactions, and online policy management. They allow insurers to improve customer satisfaction, which is key to customer retention and attracting new clients.

Data analytics and management are other aspects in which legacy modernization is important. Modern systems have data analysis tools to allow insurers to gain insights into user behavior, market trends, and risk profiles. This data is necessary for making decisions, developing new services, and working on new market opportunities. Efficient data management enables compliance with regulatory standards, necessary for the secure and regulated insurance industry.

Factors to Consider for Legacy App Modernization

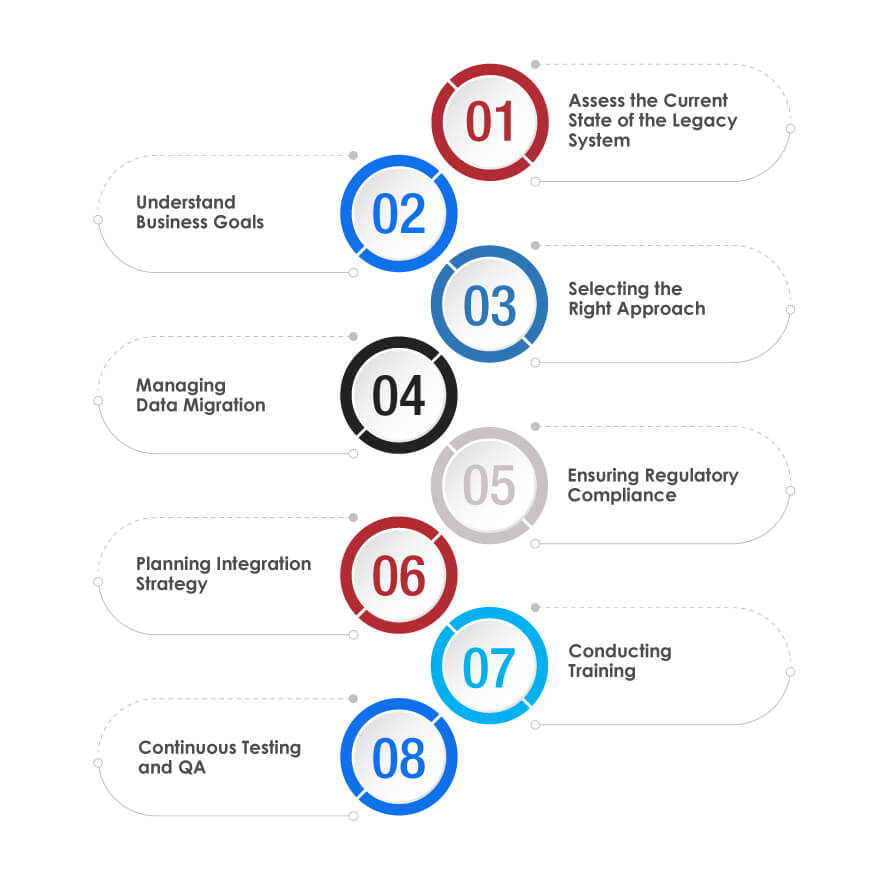

Modernizing legacy applications is a complex task, but the right strategy would result in improved efficiency and a stable system. When starting with the modernizing process, there are certain factors businesses should follow to ensure the process is successful:

Assess the Current State of the Legacy System:

Conduct a thorough assessment of the existing legacy system to understand its capabilities, limitations, and integration possibilities. Analyze how it is utilized in business processes and identify the risks and dependencies associated with their operations. It is necessary to validate the modernization level needed to optimize the legacy system.

Understand Business Goals:

Gain a clear understanding of business goals to sync them with the modernization process. The goals could be improving CX, enhancing operational efficiency, or fulfilling regulatory requirements. A complete understanding of these goals would help handle the modernization process and ensure results align with the business strategy.

Selecting the Right Approach:

There are multiple modernization approaches, such as re-hosting, architecting, re-platforming, refactoring, or replacing the entire system. Each approach has its benefits and challenges and depends on business goals, resources, cost, and time. Choose the approach that aligns with business needs and capabilities.

Managing Data Migration:

Data, a critical aspect of every business, must be handled carefully during migration. Businesses should have a detailed plan for migrating data efficiently and safely, which involves ensuring data security, integrity, and continuity. A data migration strategy will decrease the risk of data loss and allow new systems to use historical data.

Ensuring Regulatory Compliance:

The insurance industry revolves around regulations. When modernizing legacy applications, businesses should ensure compliance with existing and upcoming regulations. It includes data compliance, privacy laws, industry standards, and other legal requirements. Not adhering to regulations would result in legal issues and damage the brand’s reputation.

Planning Integration Strategy:

Legacy systems are integrated with other applications and data sources. When planning an integration strategy, keep in mind the capabilities it has. It will ensure the modernized system works in sync with other systems (within or outside the organization). It includes evaluating middleware, APIs, etc.

Conducting Training:

Modernization also involves people. Businesses should analyze its impact on the staff and provide adequate training to ensure they are prepared to work with modernized systems.

Continuous Testing and QA:

Implement continuous testing and QA strategy throughout modernization. It will allow the new system to function as expected and fulfill the performance benchmark. QA process will make identifying and fixing bugs or errors easy and fast. Partnering with a professional QA provider like TestingXperts would be a great initiative.

Benefits of Legacy Modernization in Insurance

Modernizing legacy applications offers plenty of benefits to the insurance industry. Understanding these benefits would enable insurers to make informed decisions regarding the legacy modernization approach.

Improved Efficiency:

Insurance companies can enhance their operational efficiency with legacy app modernization. It will make their system work faster and more reliably and deliver scalability features compared to legacy systems. The result would be quicker claims and policies processing, reduction in operational costs, and time spent on manual tasks. Modern systems can automate routine processes, allowing staff to focus on value-adding activities.

Optimizing Customer Experience:

Insurance customers want fast, personalized, accessible services. Modernized systems enable businesses to fulfill these requirements with enhanced digital experience. Using technologies like AI/ML, RPA, etc., for policy management, real-time chat support, and managing mobile applications improved customer engagement and satisfaction.

Data Management and Analytics:

Legacy modernization enables the integration of advanced data analytics tools. These tools help insurance companies gain data about customer behaviour and market trends and provide support in risk assessment. This facilitates data-driven decision-making, developing insurance-specific products, and identifying new opportunities to do business. A streamlined data management enables better compliance with regulatory standards.

Supports Agility and Innovation:

Modernization facilitates flexibility and integration with technologies like IoT, AI, RPA, etc. This enables insurance businesses to innovate and adapt to the changing tech market and dynamic customer needs. It also opens possibilities for new insurance models like usage-based insurance.

Enhanced Security:

Modernization leads to the upgradation of security infrastructure. It equips insurers with systems that have improved security features that can handle the latest cyber threats. In addition, modernization facilitates compliance with old and latest data protection regulations to avoid legal penalties and issues.

Long-term Cost Saving:

Although the initial investment could be high, it will be cost-efficient over time. Modern systems are efficient, low maintenance, and reduce costly support. It leads to a lower total cost of ownership in the long run.

Conclusion

Legacy modernization is a strategic necessity in the insurance industry. Insurance businesses can improve CX and process efficiency by integrating tech innovations like Gen-AI and cloud technologies. Modernization challenges like remote workforce management, ensuring data and regulatory compliance, and security concerns can simply be prevented by following certain factors. This will result in agile, flexible systems that can easily meet market demands. Integrating modernized legacy systems supports innovative business models, ensures robust data management, enhances security, and saves costs. However, to make this possible, it is crucial to partner with a professional digital transformation and QA expert who can assist in optimizing the modernization process.

Why Choose TestingXperts for Legacy Modernization in Insurance?

If you are planning for legacy app modernization and know your operations aren’t where they need to be, TestingXperts can partner with you to identify the areas of improvement. Choosing TestingXperts for legacy modernization is a smart decision for several reasons:

• We have extensive experience with various legacy systems across multiple industries, offering unique insights into the complexities of these systems.

• Our experts use modern tools and methodologies to modernize legacy systems effectively, using the latest QA technology standards.

• Our approach includes identifying potential issues early in the process and crafting strategies to ensure minimal disruptions during modernization.

• We offer scalable solutions that adapt and evolve with changing business environments, essential for growing businesses.

• Automated testing is integral to our approach, ensuring seamless software transition, reduced errors, improved time-to-market, and building trust in modernized applications.

• We use tools like Selenium, Appium, TestNG, JUnit, and Jenkins, essential for successful application modernization.

To know more, contact our QA experts now.

Discover more