Recommended Blogs

Why Should Businesses Invest in Invoice Process Automation?

Table of Contents

- What is Invoice Process Automation?

- Manual vs Automated Invoice Processing

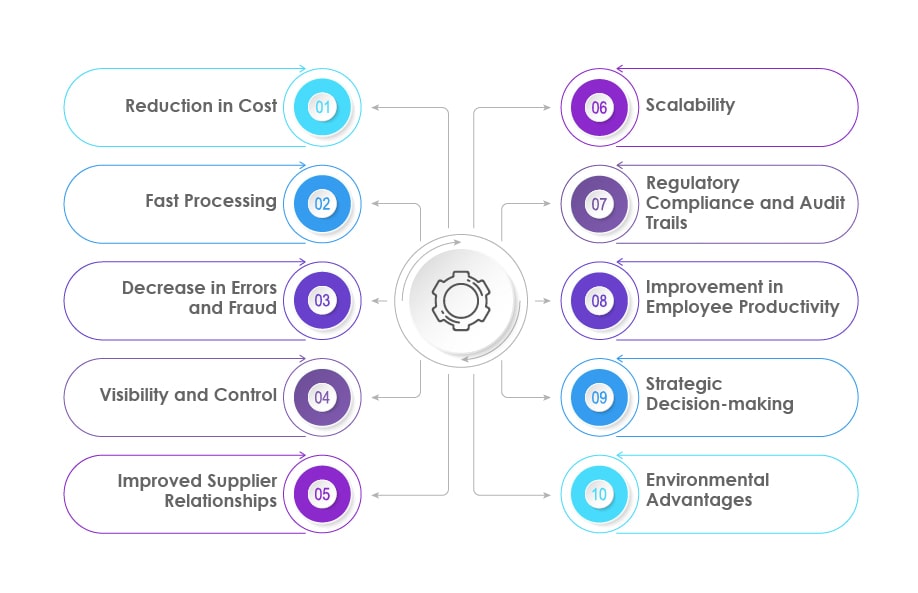

- Top 10 Benefits of Invoice Automation for Businesses

- How to Automate Invoice Processing Software?

- Summary

- How can Tx help with Automation Testing?

Managing invoices efficiently has become very important in the current digital business environment. Despite the tech advancements, some businesses still use outdated and manual processing methods. Such practices cause inefficiencies and cost increments as they do not align with the new tech updates. This is where automation comes into the picture. Invoice process automation allows businesses to eliminate inefficient manual processes that mainly cause slow down payment releases, processing errors, and overloaded paperwork.

Financially, manual invoice processing is costly based on reports showing that the average cost for manufacturers handling up to 100,000 invoices per year is around $6.10 per invoice. This cost increases to $16 per invoice for businesses processing fewer invoices. So, to manage business finances systematically and easily, automation is the answer.

What is Invoice Process Automation?

Invoice process automation (IPA) refers to using technologies like AI, ML, etc., to streamline and optimize the managing and processing of invoices. It allows businesses to shift from traditional and manual invoice handling to an automated and efficient system. This technology minimizes human involvement to reduce errors and improve efficiency. IPA supports various functions like data entry, invoice tallying with purchase orders, archiving, validations, and approval routing. Key attributes of invoice process automation include:

• Automatic extraction and processing of invoice data to reduce error rates and save time.

• Sending and receiving invoices digitally to speed up processing compared to paper-based systems.

• Facilitating integration with existing accounting software to ensure successful syncing of financial data.

• Automatic routing of invoices to authorized persons (based on predefined rules) and streamlining the approval process.

• Making the retrieval process easy and efficient by storing invoices digitally. This also helps maintain the database for future reference and ensures that the records are available for compliance and auditing purposes.

• It provides insights into transaction patterns and assists in better financial decision-making.

Manual vs Automated Invoice Processing

Top 10 Benefits of Invoice Automation for Businesses

Following are some of the benefits of the invoice automation process for businesses:

Reduction in Cost:Automated invoice processing decreases the per-invoice cost by eliminating the need for manual data entry, paperwork, and postage. It leads to direct savings. Also, decreasing the error rate cuts down costs associated with resolving discrepancies.

Fast Processing:Automation allows real-time processing of invoices, which is beneficial in managing cash flow and taking advantage of early payment discounts from suppliers. It would significantly impact on the bottom line.

Decrease in Errors and Fraud:Automation improves accuracy by reducing human errors in calculations and data entry. It includes checks for frauds like duplicate invoice detection, transaction thefts, etc., thus safeguarding financial integrity.

Visibility and Control:Businesses can immediately access the invoice’s status and financial commitments. Automated systems aid in better cash flow management and financial planning, guaranteeing payments are made on time and the budget is maintained.

Improved Supplier Relationships:Automated systems facilitate timely and accurate invoice processing to support trust and reliability with suppliers. This results in favorable payment terms and better financial support, leading to cost savings and successful business deals.

Scalability:Automated invoice processing systems are scalable as they can handle large invoices without much human intervention. This functionality is crucial for businesses to support digital expansion without increasing administrative costs.

Regulatory Compliance and Audit Trails:It helps maintain detailed records of every transaction to ensure businesses adhere to financial regulations and quickly respond to audit requests. Comprehensive record-keeping is necessary to fulfill compliance requirements and save time and effort during audits.

Improvement in Employee Productivity: Businesses can automate routine tasks to enable employees to focus on strategic initiatives. It helps boost productivity and enhances job satisfaction as staff engage in impactful work.

Strategic Decision-making:Automated systems have robust analytics and reporting tools to analyze spending patterns and business financial conditions. These insights support better decision-making to enable businesses to optimize their financial performance.

Environmental Advantages:It helps reduce paper usage, indirectly contributing to environmental sustainability. Digital invoice processing syncs with eco-friendly practices and allows businesses to reduce their carbon footprint.

How to Automate Invoice Processing Software?

Selecting the right automation approach is necessary for managing financial operations and improving the efficiency of invoice processing software. The selection process should consider business-specific needs and the implementation process, followed by rigorous automation testing. In addition to automation, the system should align with business goals and help streamline operations. The following are certain factors to consider when automating invoice processing software:• Ensure the automation tools are compatible with existing ERP or accounting software for seamless data flow and minimal manual processes.

• The automation should be customizable to meet business needs and scalable to handle growth, adapting to changes in business environments and invoice volumes.

• Choose automation solutions with intuitive interfaces to reduce the learning curve and training needs, enabling employees to adopt them quickly and efficiently.

• The automated system must comply with financial regulations and include robust data security measures to protect sensitive information and meet legal standards.

• Look for features like automated data capture, streamlined approval workflows, real-time reporting, and analytics to improve efficiency and offer valuable insights.

• Evaluate the cost-benefit ratio, focusing on the value added through increased efficiency and error reduction, not just initial cost.

• Develop a detailed plan for automation implementation, including staff training, data migration, testing, and a transition timeline.

• Thoroughly test the automated processes before full deployment. This includes implementing a test automation framework, checking for compatibility issues, and ensuring the system accurately handles invoices in various scenarios. Regular testing should continue even after implementation to ensure ongoing accuracy and efficiency.

• After implementation, continuously assess the system’s performance and ensure access to reliable technical support for improvements and issue resolution.

Summary

In the digital environment, managing invoices is crucial for business success. The transition from traditional, manual invoice processing to automated systems is necessary to reap many benefits, including significant cost reduction, improved processing speed, minimized errors, enhanced visibility, and better supplier relationships. It also offers scalability, enabling businesses to grow without increasing administrative burdens. Automated invoice processing software streamlines operations, improves decision-making and offers environmental sustainability. When selecting IPA software, businesses must consider integration ease, customization, user interface, compliance, and cost-effectiveness. It’s an investment in efficiency, accuracy, and future growth.

How can Tx help with Automation Testing?

Selecting the right automation approach is necessary for managing financial operations and improving the efficiency of invoice processing software. The selection process should consider business-specific needs and the implementation process, followed by rigorous automation testing. In addition to automation, the system should align with business goals and help streamline operations.

The following are certain factors to consider when automating invoice processing software:

• Our in-house accelerators, Tx-Automate, Tx-HyperAutomate, Tx-QSR, and Tx-SmarTest, seamlessly integrate with your automation frameworks and save scripting cost and effort.

• Our tailored advisory services help maximize efficiency, minimize risks, and ensure higher ROI with automation implementation.

• We create high-quality test automation suites using AI, enabling seamless integration with CI/CD tools and cloud platforms.

• Our automation testing approach helps reduce regression cost by 89-89% and enables faster time-to-market by up to 60-80%.

• Our portfolio includes E2E testing services, which include test advisory, functional/non-functional testing, automation, digital engineering, DevOps, Agile, Big Data, etc.• With 300+ clients served globally, we bring extensive industry experience and a broad QA and software testing perspective.To know more, contact our test automation experts now.

Aspects |

Manual Invoice Processing |

Automated Invoice Processing |

| Data Entry | Manual data entry is prone to errors. | It captures data automatically, thus significantly reducing data entry errors. |

| Processing Speed | It’s a time-consuming process due to manual handling. | Fast processing because of automation. |

| Cost Efficiency | Manual labor and error correction increase the costs. | Reduces operational costs through automation. |

| Error Rate | Higher chances of human errors. | Automated checks and balances reduce the error rate. |

| Scalability | Increased workload with more invoice processing and limited scalability. | Easy to upscale as the business process grows. |

| Compliance & Auditing | Disorganized record-keeping leads to challenges during the compliance and auditing process. | Digital records and accurate processing make it easy for businesses to adhere to compliance and auditing processes. |

| Supplier Relations | Delayed and inaccurate payments strain supplier relations. | Timely and accurate processing improves supplier relations. |

| Real-time Visibility | Limited visibility into cash flow and invoice status. | Improved visibility with real-time reporting and tracking. |

| Reporting & Analysis | Limited in-depth reporting and analysis capabilities. | Advanced analytics capability into financial insights. |

| Employee Productivity | More time is spent on manual and repetitive tasks. | Automation handles the repetitive tasks while staff can focus on strategic tasks. |

Discover more