Recommended Blogs

How AI Is Transforming Insurance Claims Processing and Management

- Evolution of Claims Management Processes

- Automating Claims Processing with AI

- Improving Customer Experience

- Challenges and Considerations in AI Implementation

- Test Automation in AI-Driven Claims Management

- Conclusion

- How TestingXperts can Help with AI Testing for Claim Management?

The use of artificial intelligence in insurance claims management process marks a significant shift in the industry, delivering enhanced efficiency and customer satisfaction. This transformation is further supported by the growing demand for faster, more accurate claims processing and AI’s ability to fulfill these demands effectively.

Moreover, 47% of insurers agree that AI enables faster claims handling, a critical factor in improving user experience and operational efficiency. The ability of AI to reduce the time taken to handle a claim by 30% to 50% further justifies its transformative impact. This speed is crucial in an industry where timely response and resolution are directly linked to customer satisfaction and trust.

On top of that, AI use in the insurance industry is expected to increase by 32 per cent by 2026. This rise shows more significant trends in the business towards being digital and automated, where AI is seen as more and more necessary. McKinsey predicts that by 2030, claims handling with the help of AI will be the most important part of insurance, underlining how important AI is in turning the business digital. Extensive testing supports this transformation, checking that AI systems work in the real-world and meet the changing needs of insurance companies and their clients.

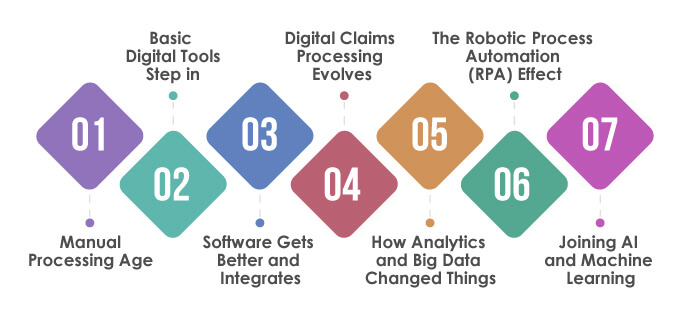

Evolution of Claims Management Processes

Significant changes can be seen in insurance claims management with the involvement of new tech upgrades and industry trends. From the start, which relied on paperwork, to now, transformed by digital and automated solutions, change points to better speed and precision. Let us look into the key stages of how the claim management process has evolved over the last few decades.

Manual Processing Age:

Claims management began heavily dependent on manual methods as it involved lots of paperwork, face-to-face reviews, and phone conversations. It was simple but inefficient and took longer to process claims, and mistakes were common as claim adjusters handled each case by hand.

Basic Digital Tools Step in:

Computers and simple digital tools started changing the process as insurance companies began going digital with their records and adopted basic software for managing data. It was a bit more organized and faster, but these early systems had their limits and couldn’t integrate with other processes.

Software Gets Better and Integrates:

As technology improved, so did claims management software. Advanced systems helped with integrating, storing, and finding data. During this time, full-featured claims management software came into being. These could handle intricate tasks like document management and workflow automation, cutting down on manual labor and boosting efficiency.

Digital Claims Processing Evolves:

The march toward fully digital claims processing was a game-changer. Digital adjudication systems automated many steps in the process. It made operations smoother and improved claim decision accuracy. It also lowered the chances of mistakes and fraudulent claims.

How Analytics and Big Data Changed Things:

The mix of big data and analytics made insurance claim management different. Now, big datasets help spot patterns, judge risks and make choices based on facts. They also use predictive models. This helps to catch and stop problems before they appear.

The Robotic Process Automation (RPA) Effect:

RPA changed how routine tasks were done in claims processing. It automated the monotonous tasks. Humans could then focus more on challenging, strategic tasks. This made things more productive, quicker, and more accurate.

Joining AI and Machine Learning:

AI and machine learning made the biggest change in managing claims. They automated many challenging tasks like assessments, finding frauds, and talking to customers. AI works with data better and quicker than humans. This means claims get solved faster and customers feel better.

Automating Claims Processing with AI

AI has reshaped the insurance industry, notably in the claims department. Traditional ways are out, and modern, quicker procedures are in. The result is a better, more precise service for customers. The new approach tackles two critical parts: making claims registration easy and handling data analysis, both playing key roles in changing the claims process.

Claims Registration Made Easy

AI has overhauled claims registration, making it straightforward and fast. In the past, policyholders would have to deal with complex forms. Now, AI-backed systems make the experience smooth. They use chatbots to guide users as they register a claim, reducing errors and incomplete data. Plus, they’re smart enough to gather essential info from different documents, ensuring details aren’t missed.

Data Entry and Analysis- All Automatic

But it’s not just about registering claims. AI takes care of data entry and analysis as well. Advanced AI tech cuts manual work by automatically pulling and sorting data from claim documents. It greatly reduces processing time and the chance of human mistakes. The systems also delve deep into the data, spotting patterns and critical insights. This is especially handy in identifying false claims as they quickly highlight anything odd. Ultimately, these AI-driven insights help insurers better understand and adjust their policies.

Improving Customer Experience

Customer experience is now central to the insurance industry, and AI is accelerating that change, particularly in claims management. Thanks to artificial intelligence, insurance companies can now provide speedier and more effective service, offering a customized, supportive journey. This change is remolding how customers engage with their insurers, raising the bar for service quality and customer satisfaction.

Speedy Claim Settlements

AI has transformed insurance, making claim settlements faster. Thanks to AI, systems analyse and process claims much quicker, which not only reduces the time needed for evaluation and settlement but also eliminates waiting periods for customers. How? Through data automation, recognizing patterns, and using forecasting analytics to aid decision-making. So, insurers can now manage more claims more effectively, boosting satisfaction and trust and making their operations more efficient.

Individualized Customer Interaction and Support

AI is now changing how insurance companies engage with customers. AI-powered bots and virtual helpers ensure 24/7 assistance and prompt answers to customer questions. From basic policy information to detailed claim process explanations, these AI tools have it covered. Moreover, AI-powered personalized communication is possible by analyzing unique customer details like preferences, history, etc. This extends to proactive help, as AI tools predict user needs, offering timely information and aid. This improves the overall customer experience.

Challenges and Considerations in AI Implementation

Using artificial intelligence in insurance claim handling comes with its hurdles and decisions. Despite AI bringing helpful changes to claim tasks, its integration into existing setups needs smart planning and execution. It is crucial to understand these hurdles for insurers to use the full potential of AI and make its adoption successful.

Tackling Data Privacy and Security

One of the main challenges in using AI for insurance claim handling is taking care of data privacy and security. AI systems deal with a lot of sensitive personal and financial data, so it is essential to protect this data from leaks and unauthorized access. Insurers must uphold strict data protection laws, like Europe’s General Data Protection Regulation (GDPR) or the United States’ Health Insurance Portability and Accountability Act (HIPAA).

Insurers must tackle these issues by taking vital security steps. Here’s what they should include:

• Robust encryption protocols are key for safeguarding essential data. This data might be at rest, like stored information, or in transit, like sent messages. Techniques such as Advanced Encryption Standard (AES) are applicable for stored data. For sent data, Secure Sockets Layer (SSL) or Transport Layer Security (TLS) look after info between systems, networks, or applications.

• Suitable access control methods make sure only approved staff get to essential data. This means user authentication and authorization strategies. Authentication confirms users are who they say they often through passwords, biometrics, or multi-factor authentication. Authorization sets and enforces user permissions, assuring individuals only access necessary data for their roles.

• Regular security checks help to spot and lessen potential dangers. These checks evaluate current security infrastructure, policies, and practices to find vulnerabilities. Plus, they review compliance with appropriate data protection rules.

• Human mistakes can lead to data leaks. Thus, staff training on data privacy and security is key to reducing this risk. Training should include recognizing phishing attempts, securely handling data, managing passwords, and understanding the organization’s data privacy policies.

Managing the Transition to AI-Based Systems

Switching from old-school, hands-on routines to AI is a big challenge. It’s a technological shift in tech, office workflow, and daily tasks. Key parts of this switch-up are:

• Getting the go-ahead from everyone involved – management, staff, and clients. This means explaining the plus points of AI and facing any concerns or doubts head on.

• Make sure staff gets lots of practice with the new AI tools. This includes workshops and tutorials on how AI can enhance their work and choices.

• Moving forward in steps can help the transition go smoother. Starting with trial runs or picking out specific claim tasks can let the team adjust slowly and tweak things as they go.

• Keep a close eye on how well the AI tools are doing and see how they’re shaping the claim processing. This includes marked milestones for success and changing goals if needed based on the data collected and any comments.

Test Automation in AI-Driven Claims Management

In AI-focused claims management, test automation makes AI systems trustworthy and efficient. As AI tools interact more with insurance, businesses need to validate these systems often. Test automation helps by ensuring that AI processes work at their best and provide accurate results.

Role and Importance of Test Automation

AI-driven claims management use test automation to checks that AI algorithms are correct because they work with important insurance claim data. Automated tests check the AI models, which is quicker and could be more reliable than manual checks. Over time, test automation helps keep the AI system unbiased. AI models change as they learn, and regular testing check that the new changes stick to the plan without adding new mistakes or vulnerabilities.

Best Practices and Techniques in Test Automation

Continuous Testing Integration:

Continuous testing involves integrating the testing process into the continuous development cycle of AI models. This approach ensures that any changes, updates, or new features in the AI system are immediately tested. It helps identify and rectify issues early in development, reducing the risk of significant flaws or system failures at later stages.

Data-Driven Testing:

This practice uses real-world data scenarios to validate AI models. By testing AI systems with diverse, real-world data sets, insurers can ensure that their AI models are robust, can handle the complexities of real insurance claims, and are prepared for various scenarios they may encounter in actual operations.

Specialized Testing Tools:

AI systems, particularly those in claims management, require specific testing methodologies that standard software testing tools may not provide. Using tools designed explicitly for AI testing ensures that complex aspects like machine learning algorithms are properly evaluated and ethical AI practices are upheld.

Scalability Testing:

This type of testing assesses whether the AI system can handle varying volumes of claims without compromising on performance. It is crucial to ensure that the system remains efficient and effective despite high demand, common in natural disasters or large-scale incidents.

Security Testing:

Security testing is vital to protect sensitive data involved in insurance claims. This practice includes testing for vulnerabilities that could lead to data breaches and ensuring compliance with data protection regulations. It helps maintain client trust and uphold the insurer’s reputation.

User Experience Testing:

This testing focuses on the interface and interactions of the AI system from the user’s perspective. It ensures the system is intuitive, easy to navigate, and efficient for claimants and insurance agents. A positive user experience is crucial for customer satisfaction and adoption of the system.

Performance Benchmarking:

Regular benchmarking against performance standards helps maintain and improve the quality of the AI system. It involves assessing various performance metrics like processing speed, accuracy, and response time, ensuring the system meets the expected standards of efficiency and reliability.

Regression Testing:

Whenever updates or changes are made to the AI system, regression testing ensures that these new changes do not negatively impact existing functionalities. It is crucial for maintaining the stability of the system after updates.

Cross-Platform Compatibility Testing:

This testing ensures that the AI system works seamlessly across various platforms and devices. With the increasing use of mobile devices and diverse operating systems, cross-platform compatibility is essential for providing accessible and consistent service to all users.

Conclusion

AI brings significant changes to how insurance businesses handle insurance claims. It can do lots of stuff in claims processing, from doing everyday tasks by itself to making customer chats better. This cool tech makes work smooth and gives better service to those who bought insurance. AI-powered tools are there to help 24/7 and adjust chats based on each customer’s needs, making the insurance process easier and friendlier. But putting AI in claims handling is not all easy. Issues like keeping data safe, security, and moving to AI systems need good thinking and planning. Solving these issues is a must for businesses to make the most out of AI.

How TestingXperts can Help with AI Testing for Claim Management?

TestingXperts provides top-tier AI testing services, focusing on improving claims management. Our AI testing skills help make your AI-based systems both effective and dependable, tailoring to the changing needs of the insurance sector. Here’s why you should partner with TestingXperts for AI testing services:

• Using AI and Robotic Process Automation (RPA), we speed up testing, thus shortening the launch time for AI-based claim management systems.

• Grasping the diverse needs of each insurance firm, TestingXperts delivers custom-made testing solutions to coincide with your claims management system’s specific demands.

• Our advanced automated testing capacities permit us to perform widespread, meticulous testing more rapidly and precisely. We make use of a variety of cutting-edge automated testing utilities and structures designed precisely for claim management systems’ intricacy and subtlety.

• Our in-house automation framework, Tx-Automate, refines the testing process, offering a sturdy, adaptable, and scalable platform ideally suited to AI-integrated environments.

• We conduct extensive testing, checking various aspects of AI in claims management, such as data precision, algorithm efficiency, scalability, security, and user interface.

• We conduct a full-scale analysis of AI systems by employing cutting-edge AI testing tools and methods like data-oriented testing and performance testing.

• Security and testing compliance are vital when dealing with delicate insurance claim data. We ensure that our AI systems follow data protection laws and guidelines.

To know more, contact our QA experts now.

Discover more

Stay Updated

Subscribe for more info