Recommended Blogs

Why is Testing Essential for Insurance Policy Administration Systems?

- Insurance Policy Administration System

- Why is Software Testing Essential for Policy Admin Systems

- Policy Admin Systems Testing Challenges and Best Practices

- Testing Cloud-based Policy Administration System

- How can Tx assist with Insurance Domain Testing?

- Summary

Insurance is a service-oriented, policy-centered, and product-specific industry. The business processes witness frequent updates, transactions, communication, and interactions between stakeholders (agents, IT teams, customers, and marketing teams). Its increasing complexity and dependency on tech innovations have given rise to the adoption of insurance policy administration systems (PASs). A policy admin system is an application that allows insurance businesses to manage the E2E lifecycle of a policy. PAS validation involves confirming policyholder’s details like name, age, address, eligibility rules, verification according to Line of Business, specialty lines policies, and catastrophe coverage.

One can say that PAS is the backbone of insurance operations as it manages policies and integrates various essentials for efficient service delivery. This makes comprehensive testing critical to ensure these systems’ performance, compliance, and reliability.

Insurance Policy Administration System

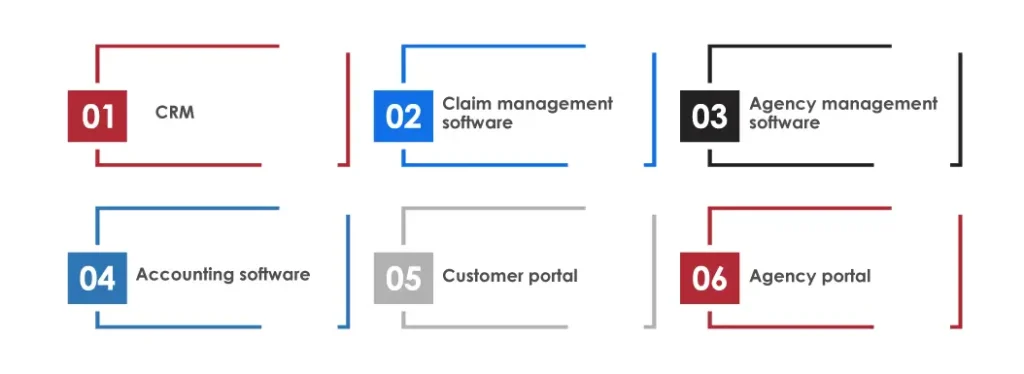

An insurance policy administration system assists in streamlining the management of the entire policy lifecycle. It involves handling processes from issuance to billing to endorsement to termination. Insurance companies use this software to enable analytics-driven risk assessment, draft policy pricing, and analyze demand forecasting. It also facilitates automated recordkeeping and provides centralized storage for all policy-related information. Custom insurance PAS software assists companies in handling complex policy management processes and varying insurance product portfolios. The demand for PAS software is always high because it can easily integrate with crucial portals, such as:

- CRM

- Claim management software

- Agency management software

- Accounting software

- Customer Portal.

- Agency Portal

Why is Software Testing Essential for Policy Admin Systems?

Insurance businesses are mandated by governments and financial institutes, e.g. NCCI and their standards, as they deal with many policyholders comprising joint and individual customers. They must ensure a seamless connection among a huge insurance plan ecosystem, policyholders, and claim processing, which is challenging. Ensuring software robustness has a lot to do with handling millions of policies, state and federal legislation, sponsors, claim rules, and plan details. Also, as the application grows with the insurance coverage area, the chances of defects and their impact grow simultaneously.

The impact could be in the form of a reduced customer base due to poor CX, flawed transactions, compromised data security, and miscommunication of policy information. This is why it is essential to conduct comprehensive software testing of insurance policy administration systems. PAS testing will incorporate business logic, external interfaces, and the most critical parts of the IT system. Insurance businesses need to incorporate the following elements within their QA strategy to ensure comprehensive test coverage and remediation of defects:

- Policyholder, prospect, and producer portals

- Underwriting, rating engine and rating algorithms

- Policy and product servers

- Identity, forms, document, and access control management

- Product and policy admin UI

- API authorization and authentication

- Claim processing and customer retention opportunities

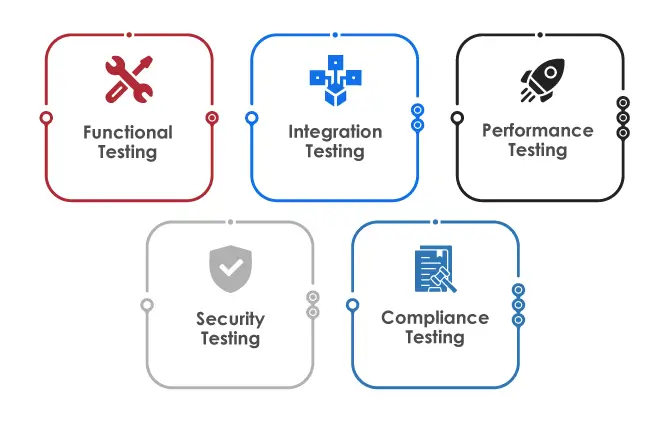

Testing Types for Insurance PAS

- Functional Testing: To ensure all system operations are performing per business expectations.

- Integration Testing: To test the interfaces between the policy admin system and external systems and ensure smooth data flow and functionality.

- Performance Testing: To assess the system’s stability and response time under varying load conditions.

- Security Testing: To identify vulnerabilities in the PAS to prevent data breaches and ensure data integrity.

- Compliance Testing: To ensure PAS meets all regulatory requirements and industry standards.

Policy Admin Systems Testing Challenges and Best Practices

| Category | Testing Challenges | Best Practices |

| Complexity | High complexity of insurance products and regulations | Develop detailed test cases to cover all business scenarios |

| Customizable policies leading to diverse testing practices | Regularly update test cases to reflect changes in products and regulations | |

| Integration | Integration with multiple internal and external systems | Use integration testing to ensure data flows correctly between systems |

| Data synchronization issues | Implement continuous integration practices | |

| Performance | Handling large volumes of transactions | Conduct performance testing to ensure system scalability and stability |

| System slowdowns during peak operational hours | Use robust performance testing tools to simulate peak loads | |

| Security | Vulnerabilities due to extensive data access and storage | Perform thorough security testing using advanced security testing tools |

| Risks of data breaches | Regular security audits and updates to security protocols | |

| Compliance | Adherence to numerous and varying regulatory requirements | Regular compliance testing to ensure adherence to all legal standards |

| Updating systems in line with regulatory changes | Maintain documentation of testing protocols for audit purposes | |

| Resource Management | Allocation of adequate testing resources and tools | Plan resource allocation early in the project to ensure availability |

| Balancing the testing phases with the project timelines | Use test management tools to track progress and resource usage |

Testing Cloud-based Policy Administration System

Testing cloud-based insurance PAS is necessary due to the strict security, compliance, and functionality requirements imposed by financial institutions and regulatory bodies. Regardless of how detailed the system’s performance is, insurers must conduct comprehensive PAS testing in the following areas:

- Ensuring accuracy in initial quote calculations

- Verifying the enforceability and correctness of policy bindings

- Confirming proper handling and documentation of policy modifications

- Checking the accuracy and timeliness of policy renewals

- Evaluating the capture and processing of driver and vehicle data in P&C policies

- Checking the system’s ability to handle customer adjustments in risk assessment and rating processes

- Testing workflows for specialty insurance products to ensure seamless operations from policy quote to issuance

How can Tx assist with Insurance Policy Admin Systems Testing?

Tx has extensive insurance industry experience enabling next-gen specialist QA and software testing services for global clients. We leverage our in-house accelerators and RPA-based automation frameworks to deliver scalable and robust insurance products with faster testing outcomes. Partnering with Tx for software testing of insurance policy administration systems will give you the following benefits:

- Improved IT efficiency with seamless QA services and reduced total cost of ownership (TCO).

- Customized integrating testing scenarios that cover comprehensive insurance business rules.

- Ensure your policy admin system complies with industry regulations while you seamlessly manage third-party vendor systems with flexible integrations.

- 100% automation of smoke and regression tests for rapid testing outcomes.

- Ensure 30% faster time-to-market with AI and RPA-based automation.

- 40% reduction in overall testing costs with reusable test scripts.

Summary

In today’s dynamic business environment, intuitive user interfaces are playing an important role in ensuring greater insurance service with automated underwriting. Insurance policy administration systems’ health depends on their utility, security, functionality, and performance. It is the sole application that connects multiple stakeholders, creates insurance coverage for a huge user base, and se, and consolidates transactions, thus making it necessary to ensure its quality is visible, actionable, and visible. As one of the leading insurance testing services providers, Tx can help you optimize your PAS quality, reliability, and security. To know how Tx can help, contact our experts now.

Discover more