Recommended Blogs

RPA in Insurance – Better Processes and Improved Productivity

Table of Contents:

- Why do Insurance Companies need RPA for their Business?

- Common Challenges and Key Considerations of RPA in Insurance

- How does RPA help in Insurance?

- How can TestingXperts help you with RPA services?

Robotic Process Automation in insurance is no longer a choice but a strategic imperative. It is fundamentally transforming the way insurance companies operate, enabling them to stay competitive in a rapidly evolving landscape. RPA in insurance addresses numerous pain points, such as repetitive manual tasks, errors, and slow claims processing, while also reducing operational costs and mitigating compliance risks. It empowers insurers to enhance customer service, providing faster and more responsive interactions, which are increasingly critical in a customer-centric world. Moreover, it facilitates the integration and analysis of vast amounts of data, enabling better risk assessment and management. As insurers grapple with growing demands, fierce competition, and the need for operational efficiency, RPA emerges as the center for success, empowering the industry to operate with greater precision, speed, and agility.

Why do Insurance Companies need RPA for their Business?

According to a report by McKinsey, insurance companies can achieve operational cost reductions of 30-50% by implementing RPA in insurance. Furthermore, a survey conducted by Deloitte found that 78% of insurance executives believe that automation and RPA will have a significant impact on their business.

Failure to adopt RPA can result in inefficiencies, costly errors, and missed opportunities. One notable example is the Equifax data breach in 2017, where the credit reporting company’s failure to automate cybersecurity patching led to a massive breach affecting 147 million people. In the insurance industry, the lack of automation can lead to delayed claims processing, data entry errors, and compliance violations, potentially resulting in financial losses and customer dissatisfaction.

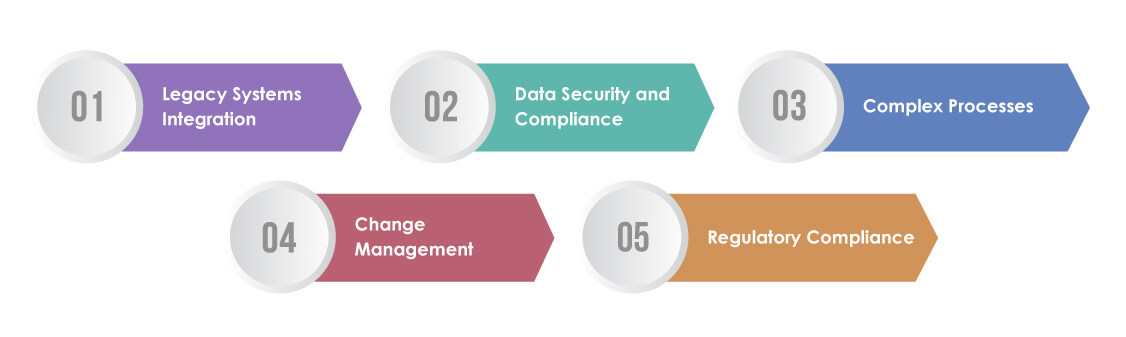

Common Challenges and Key Considerations of RPA in Insurance

Implementing Robotic Process Automation (RPA) in the insurance industry offers the promise of streamlining operations, reducing costs, and enhancing customer service. However, it also comes with a set of common challenges that need to be carefully addressed:

Legacy Systems Integration:

Insurance companies often operate with legacy systems and a diverse technology landscape. Integrating RPA into these systems can be complex. RPA tools need to interact seamlessly with these legacy platforms, which may lack modern APIs or automation-friendly interfaces. Customizations and workarounds are often necessary to bridge this gap.

Data Security and Compliance:

The insurance sector deals with vast amounts of sensitive customer data and confidential information. Ensuring the security and privacy of this data while implementing RPA is paramount. Compliance with industry-specific regulations, such as HIPAA in healthcare or GDPR in Europe, adds an additional layer of complexity. Ensuring that RPA systems adhere to these standards while handling data is a significant challenge.

Complex Processes:

Insurance processes can be intricate and often involve complex decision trees and rule-based operations. RPA bots need to be capable of understanding and handling these intricacies, which can require sophisticated scripting and logic. Developing bots that can navigate the complexities of underwriting, claims processing, and policy administration is a formidable challenge.

Change Management:

Introducing RPA in insurance leads to concerns among employees about the potential for job displacement. Effective change management is necessary to address these concerns and emphasize that RPA is intended to augment human capabilities, not replace them. Staff training and collaboration with RPA systems need to be integrated seamlessly into the work environment.

Regulatory Compliance:

The insurance industry is heavily regulated, and insurers must comply with a myriad of laws and regulations. RPA systems need to operate in accordance with these standards. Ensuring that RPA processes and data handling align with industry-specific laws and data protection regulations can be complex. Continuous monitoring and adaptation to regulatory changes are necessary to avoid compliance issues.

How does RPA help in Insurance?

The RPA addresses a myriad of challenges and provides numerous advantages that redefine the way insurers operate. Here is an in-depth exploration of how RPA helps in insurance:

Automation of Repetitive Tasks:

Insurance processes are often burdened with repetitive, rule-based tasks that are not only time-consuming but also prone to human error. RPA excels at automating these mundane activities, such as data entry, document processing, and data extraction. This automation leads to increased operational efficiency and frees up human resources to focus on more complex and value-added tasks.

Expedited Claims Processing:

Claims processing is a critical aspect of the insurance industry, and the speed and accuracy of this process significantly impacts customer satisfaction. RPA takes over the labor-intensive tasks involved in claims assessment, including data validation, risk evaluation, and payout calculations. This results in faster claims settlements, reducing the time it takes for policyholders to receive their payouts and enhancing overall customer experience.

Enhanced Customer Service:

In today’s digital age, customers expect quick and responsive service. RPA in insurance plays a crucial role in improving customer service by enabling insurers to implement chatbots and virtual assistants. These automated agents are available 24/7 to answer customer inquiries, provide policy information, and assist with routine tasks. The result is an enriched customer experience, with faster response times and personalized support.

Streamlined Underwriting:

RPA automates the data-intensive underwriting process by swiftly collecting, validating, and assessing data from various sources. This automation not only accelerates the underwriting process but also enhances the accuracy of risk assessment. Insurers can make informed decisions regarding policy issuance, leading to improved risk management and customer-centric offerings.

Compliance and Reporting:

Compliance with industry regulations and accurate reporting are imperative for insurers. RPA in insurance ensures that compliance monitoring and reporting are automated, reducing the risk of non-compliance and associated fines. This technology is programmed to perform continuous checks to ensure that insurance operations align with regulatory requirements.

Data Integration:

Insurers work with data from diverse sources and systems, which can lead to challenges in data integration. RPA seamlessly integrates data, ensuring that insurers have access to accurate and up-to-date information. This capability is particularly crucial in the insurance sector, where data accuracy is essential for making critical decisions regarding claims, underwriting, and risk assessment.

Reduced Operational Costs:

Manual processes are often resource-intensive and expensive. By automating routine tasks, RPA significantly reduces operational costs, including labor expenses. This efficiency leads to improved profitability, making insurers more competitive in a dynamic market.

Scalability:

RPA systems are highly scalable, allowing insurers to handle increased workloads without the need for substantial investments in infrastructure or personnel. As insurers grow or face seasonal fluctuations, RPA adapts to accommodate these changes, ensuring that operations remain efficient and cost-effective.

Efficient Document Management:

Insurance operations involve handling vast number of documents, including policies, claims, and legal documents. RPA in insurance is adept at efficiently managing and processing these documents, reducing the time and effort required for document-related tasks. This leads to better document accuracy, retrieval, and management.

How can TestingXperts help you with RPA services?

TestingXperts can be your trusted partner in implementing RPA solutions in the insurance sector. With our deep expertise in automation and a profound understanding of the insurance industry’s intricacies, we can guide you through the entire journey. Our services encompass consultation, strategy development, process assessment, tool selection, bot development, and deployment. We prioritize data security and regulatory compliance to safeguard sensitive customer information. Continuous monitoring and support ensure your RPA bots perform optimally, and we provide training and change management assistance for a seamless transition. With TestingXperts, you can enhance operational efficiency, reduce costs, and elevate customer service by integrating RPA into your insurance processes. Our custom RPA solutions cater to your unique requirements, allowing you to stay ahead in the evolving insurance era.

Consultation and Strategy Development:

TestingXperts can collaborate with insurers to assess their current processes and identify areas suitable for automation. We help develop a tailored RPA strategy that aligns with your business goals, compliance requirements, and operational needs.

Process Assessment and Selection:

We assist in identifying the most suitable processes for automation. This involves evaluating processes based on their complexity, volume, and potential return on investment (ROI).

Continuous Monitoring and Support:

TestingXperts provides ongoing monitoring and support for RPA bots, ensuring they perform as expected. We can make adjustments and improvements to bots as needed to maintain their effectiveness.

Change Management and Training:

We assist in change management initiatives to ensure a smooth transition to RPA. Our training programs help employees adapt to working alongside automation and understand the benefits it brings.

Discover more

Stay Updated

Subscribe for more info