Recommended Blogs

Robotic Process Automation in Finance – What’s the Buzz and Why Should You Care

- Robotic Process Automation in Finance – Transforming the Industry

- How does Implementing RPA in Finance help Overcome these Challenges?

- Some Key Use Cases of Robotic Process Automation in Finance

- How to Deploy RPA in Banking & Finance

- Conclusion

When it comes to the potential use cases for Robotic Process Automation (RPA), many things may come to mind, from copywriting to coding, but using the technology in the financial sector most likely won’t be the first thing. However, just like AI in IT and healthcare, Robotic Process Automation in finance has many applications. In this blog, we’ll talk about the benefits and the challenges of RPA in finance.

The adoption of RPA in the finance sector has seen rapid growth in recent years. 53% of organisations have already started their RPA journey, with a predicted increase to 72% in the next two years – Deloitte. In addition, a study by Gartner forecasts that by 2024, enterprises will lower operational costs by 30% by combining hyper-automation technologies with redefined operational processes. This increase in RPA in finance is driven by the need for accuracy, efficiency, and compliance in financial processes.

Robotic Process Automation in Finance – Transforming the Industry

Utilized in multiple industries, Robotic Process Automation (RPA) refers to the use of low-code software “bots” to handle the time-consuming, repetitive tasks of humans – like invoice processing, compliance reporting, data entry, etc. RPA is a part of the greater trend, enabling enterprises to move from automation that copies human actions towards automation that uses data to analyse end-to-end finance processes.

The robots used in RPA work better to handle a large volume of recurring tasks without human involvement. This saves time for employees to pay attention on more meaningful tasks, from building great ideas into new financial products.

Have you encountered these common challenges in finance?

• Manual data entry errors

• High operational costs

• Slow transaction processing

• Regulatory compliance

• Inefficiency reporting

• Customer service reporting

• Lack of standardization processes

How does Implementing RPA in Finance help Overcome these Challenges?

• Using Robotic Process Automation (RPA) in finance aids in fighting against the major industry challenges by automating and optimizing processes that were traditionally manual, prone to error, and resource-intensive.

• Automates data entry while ensuring consistency and accuracy. This reduces human error, resulting in more reliable financial records and reporting.

• RPA updates the processes automatically which helps reflect on regulatory changes, conduct regular compliance checks, and generate audit trails for regulatory reviews.

• RPA saves costs by automating repetitive and mundane tasks. This allows financial enterprises to better resource utilization and invest in growth-oriented initiatives.

• RPA enforces standardization across the finance organization, ensuring that financial operations are aligned, reliable and in line with the best practices. This leads to better quality and reduced variability in outputs.

Some Key Use Cases of Robotic Process Automation in Finance

Accounts Payable and Receivable Automation

RPA automates the whole process of handling invoices, account reconciliation, and payment approvals. It decreases processing time and errors while ensuring timely payments and actual financial records.

Financial Reporting

Using RPA also automate the preparation and distribution of financial statements, profit and loss accounts, and balance sheets. This reduces the overall workload on financial teams while delivering accurate reporting.

Fraud Detection and Prevention

RPA monitor your transactions in real time while detecting patterns and anomalies that may refer to fraudulent activity. This helps in quick response and mitigation measures to prevent financial losses.

Expense Management

Using RPA help automate the tracking, approval, and reimbursement of employee expenditures. RPA makes sure to deliver compliance with company policies, decreases processing time, and reduces errors in expense management.

KYC (Know Your Customer) Process

RPA enhances the KYC process by automating background checks, customer verification, and documentation. It helps reduce the time required for different processes and ensure regulatory compliance.

How to Deploy RPA in Banking & Finance

Considering the potential of RPA solutions in finance, the question is how should companies implement them to double their value. – Combination of specific automation techniques and automation technologies.

• Refine the process using the people-centred and journey-based reach.

• Draft a process from scratch and not change the existing procedure

• Access the full potential for automation considering the hierarchy and type of roles

• Match the fundamentals through agile sprints and rollout in releases

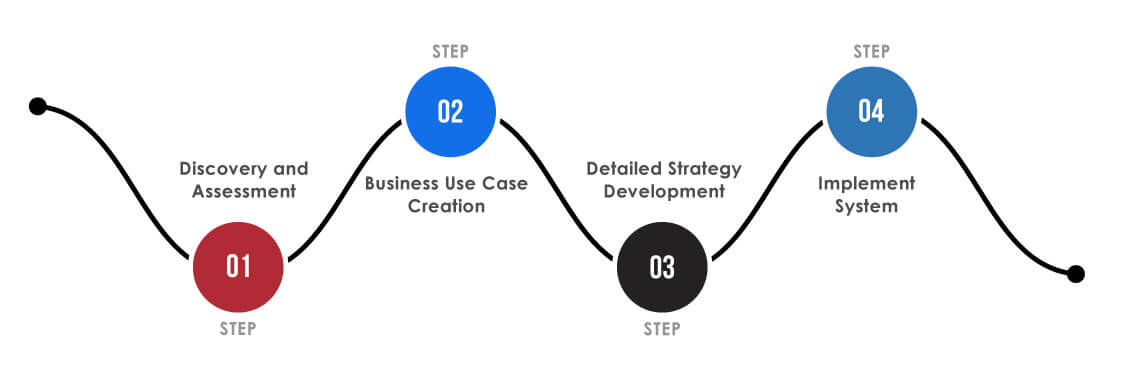

Step-by-Step Deployment:

Discovery and Assessment

As an initial step analyze your organization’s operations and functions and determine who would benefit most from RPA implementation. Once done, identify the issues your organization faces and which of them will be solved with the help of automation.

Business Use Case Creation

Based on earlier outlines of use cases of RPA in finance, you get an idea of your industry. You can connect those examples with your company and estimate the investment vs. Gains that RPA will bring.

Detailed Strategy Development

With thorough assessment and use case creation, your automation path is shaped, at this stage, you need to start creating a plan based on the collected information. Choose an operating model for your RPA based tasks and fit it to your company’s requirements for seamless implementation.

Implement System

Once done with the first three steps, it is time to put your robots to work. After its implementation, train your team to adapt to the new processes so that all stakeholders can enjoy greater efficiency and higher speeds of task completion.

Conclusion

Robotic Process Automation (RPA) in finance is not just a buzzword; it’s a transformative technology that offers tangible benefits and competitive advantages. By automating repetitive, error-prone tasks, RPA significantly enhances operational efficiency, accuracy, and compliance while reducing costs. Financial institutions that embrace RPA can better allocate resources, improve customer experiences, and stay ahead in an increasingly competitive and regulated industry.

As the financial sector continues to evolve, RPA stands out as a critical enabler of digital transformation, ensuring that organizations remain agile, innovative, and resilient. In essence, RPA is revolutionizing the way financial services operate, making it an indispensable tool for any forward-thinking financial institution.

Discover more

Stay Updated

Subscribe for more info