Recommended Blogs

How Digital Assurance is Maximizing the Insurance Processing Efficiency

Table of Contents

- Challenges in the Insurance Sector

- Role of Digital Assurance in Insurance

- Best Practices for Digital Assurance in Insurance Sector

- Conclusion

- How TestingXperts can help you make a difference with Digital Assurance Services in the Insurance Sector?

Digital assurance in the insurance industry has emerged as a profound catalyst for change, redefining the way insurance companies operate, interact with their customers, and manage their processes. Traditional insurance practices have been significantly influenced by the integration of modern technologies, altering the landscape of industry.

From artificial intelligence and machine learning to blockchain and data analytics, these digital advancements are enabling insurers to streamline operations, enhance customer engagement, mitigate risks, and ultimately drive business growth. Through an exploration of key technological trends and their impact, we aim to provide insights into how digital transformation is revolutionizing insurance, offering a glimpse into a future that is driven by innovation, efficiency, and customer-centricity.

Challenges in the Insurance Sector

The insurance industry, like many others, is experiencing a digital revolution that is transforming the way business is conducted. However, this transformation is not without its fair share of challenges. In this section, we will delve into three significant challenges the insurance sector faces in this digital era:

1. Legacy Systems and Modernization Challenges

One of the foremost challenges that the insurance sector grapples with is the presence of legacy systems. Many insurance companies still rely on outdated technologies and infrastructure that have been in place for decades. These legacy systems are often characterized by rigid architecture, limited interoperability, and high maintenance costs. Integrating new digital technologies seamlessly into such systems can be incredibly challenging and costly.

Modernization challenges arise from the need to upgrade and migrate from these legacy systems to newer, more agile and efficient platforms. The process involves careful planning, substantial investment, data migration, retraining of staff, and ensuring uninterrupted business operations during the transition. Failure to effectively modernize can impede innovation, slow down processes, and hinder the ability to adapt to evolving market demands.

2. Regulatory Compliance and Data Security

The insurance sector operates in a highly regulated environment, subject to a multitude of local and international laws and regulations. Compliance with these regulations is mandatory to maintain legal standing and ensure customer trust. However, keeping up with the ever-changing regulatory landscape can be complex and demanding.

Data security is a critical aspect of regulatory compliance. Insurers handle vast amounts of sensitive personal and financial data. Safeguarding this data from cyber threats, breaches, or unauthorized access is a paramount concern. With cyber-attacks becoming increasingly sophisticated, insurers need robust cybersecurity measures and protocols to mitigate risks. Striking the right balance between data accessibility for operational efficiency and stringent data security measures is a significant challenge.

3. Customer Expectations and Digital Experience

Advancements in technology have fundamentally altered customer expectations and experiences across all industries, including insurance. Modern consumers, accustomed to seamless online experiences offered by tech giants, expect similar levels of convenience, speed, and personalization from their insurers.

Digital experience encompasses an intuitive and user-friendly interface across various channels such as websites, mobile apps, and customer portals. Meeting these expectations requires a comprehensive digital strategy that includes user-centric design, personalized services, and efficient claims processing. Insurers must invest in emerging technologies like artificial intelligence and big data analytics to harness insights and enhance the overall customer journey.

Role of Digital Assurance in Insurance

Digital Assurance plays a pivotal role in revolutionizing the insurance sector, ensuring a seamless transition into the digital era while maintaining the highest standards of quality, reliability, and security. In this section, we will explore the critical aspects of the role of Digital Assurance in insurance, focusing on ensuring quality and reliability in digital processes, mitigating risks and security threats, and enhancing customer experience.

1. Ensuring Quality and Reliability in Digital Processes

The integration of digital technologies brings efficiency and speed to insurance processes, impacting various aspects such as underwriting, claims processing, policy management, and customer interactions. However, with this acceleration comes the challenge of maintaining the quality and reliability of these processes.

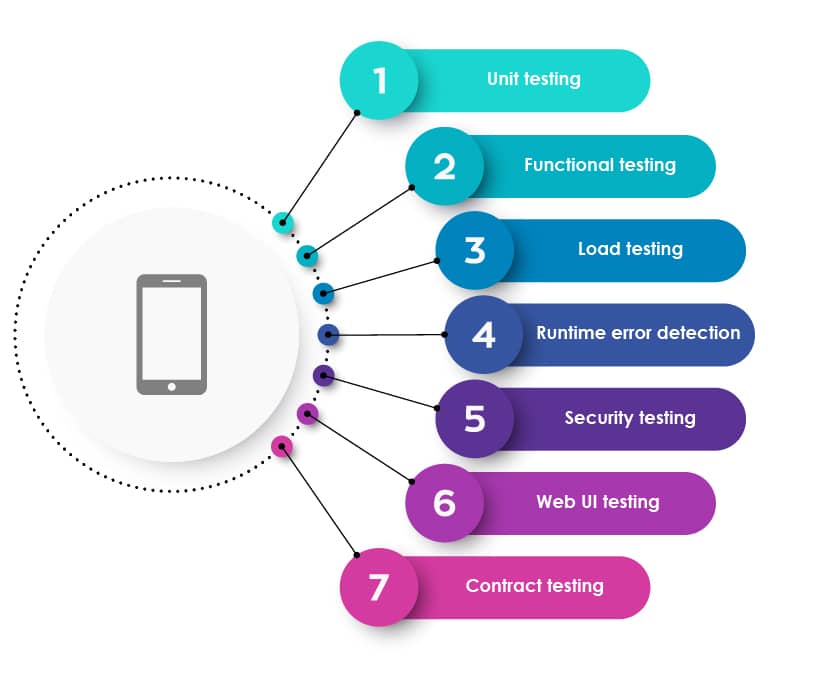

Digital Assurance involves comprehensive testing, validation, and monitoring of digital systems and applications. It ensures that software applications, mobile apps, web platforms, and other digital solutions function as intended across various devices and operating systems. Through systematic testing protocols, including functional testing, performance testing, and usability testing, Digital Assurance guarantees that the digital processes are error-free, responsive, and able to handle the expected load. This helps in delivering a reliable and seamless digital experience to both customers and stakeholders.

2. Mitigating Risks and Security Threats

The insurance industry handles a vast amount of sensitive and confidential data. As insurers transition to digital platforms, the risk of cyber-attacks and data breaches becomes significantly heightened. Ensuring the security and privacy of this data is a paramount concern for the industry.

Digital Assurance plays a vital role in mitigating these risks by identifying vulnerabilities and weaknesses within digital systems. It involves rigorous security testing, penetration testing, and vulnerability assessments to uncover potential points of exploitation. Through these assessments, security gaps can be rectified, and appropriate measures can be implemented to fortify the digital infrastructure, providing a robust defense against security threats and cyber-attacks.

3. Enhancing Customer Experience through Digital Assurance

In an age where customer experience is a defining factor for success, providing a seamless and delightful digital experience is non-negotiable. Digital Assurance is instrumental in enhancing customer experience across all touchpoints of interaction.

Through usability testing, interface testing, and performance optimization, Digital Assurance ensures that digital platforms are user-friendly, intuitive, and responsive. It identifies areas of improvement, allowing insurers to tailor their digital solutions to meet the unique needs and preferences of their customers. Additionally, by reducing downtime and resolving issues swiftly through proactive monitoring, Digital Assurance contributes to an enhanced customer experience by providing uninterrupted service and support.

Best Practices for Digital Assurance in Insurance Sector

Implementing robust Digital Assurance practices is essential for ensuring the quality, security, and reliability of digital solutions in the insurance sector. In this section, we will delve into the best practices for Digital Assurance, focusing on implementing a comprehensive digital assurance strategy, collaborative testing approaches, and continuous monitoring and improvement.

Implementing a Comprehensive Digital Assurance Strategy

A comprehensive digital assurance strategy is foundational to successful digital transformation within the insurance sector. It involves a structured approach to testing, validating, and ensuring the quality of digital products and processes. Key aspects of an effective digital assurance strategy include:

Requirement Analysis and Test Planning:

Thoroughly understanding project requirements and devising a detailed test plan to align testing efforts with project goals.

Automation Integration:

Strategically integrating test automation into the development lifecycle to optimize testing efficiency, reduce testing time, and enhance test coverage.

Compliance and Regulatory Adherence:

Incorporating compliance checks and regulatory validations to ensure that digital solutions adhere to industry standards and legal requirements.

Scalability and Flexibility:

Designing a strategy that allows for scalability and flexibility to accommodate changes, updates, and expansions in the digital landscape.

Collaborative Testing Approaches

Collaborative testing approaches involve engaging multidisciplinary teams and stakeholders in the testing process to enhance the quality of digital solutions. Effective collaboration fosters a culture of teamwork, creativity, and shared accountability. Key elements of collaborative testing include:

Cross-Functional Teams:

Forming teams with diverse skill sets to bring varied perspectives and expertise to the testing process, improving the identification of potential issues and solutions.

Early Involvement:

Involving testers, developers, and stakeholders early in the development lifecycle to identify and address issues at the earliest stage, reducing the cost and effort of fixing them later.

Transparent Communication:

Establishing open and transparent communication channels to facilitate knowledge sharing, problem-solving, and efficient decision-making throughout the testing process.

Continuous Monitoring and Improvement

Continuous monitoring and improvement ensure that digital solutions maintain their performance, security, and quality even after deployment. This iterative process involves ongoing evaluation and enhancement based on feedback and changing requirements. Key components of continuous monitoring and improvement include:

Real-Time Monitoring:

Implementing tools and systems that monitor application performance, user interactions, and security in real-time to identify and address issues promptly.

Feedback Loop:

Creating a feedback loop involving end-users, stakeholders, and development teams to gather insights, identify areas of improvement, and prioritize enhancements.

Agile and DevOps Integration:

Introducing Agile and DevOps methodologies to enhance collaboration, accelerate feedback loops, and foster continuous improvement throughout the development and maintenance lifecycle.

Conclusion

The dynamic facet of technology is reshaping traditional practices and embracing a future where efficiency, reliability, and innovation converge seamlessly. Digital Assurance is not merely a testing process; it’s a vanguard ensuring that every line of code, every digital interface, and every algorithm performs flawlessly. It fortifies the insurance sector against the tide of disruptions, offering a steadfast shield against risks, cyber threats, and data vulnerabilities. Through precise testing, validation, and continuous monitoring, Digital Assurance fuels a transformation that is customer-centric, secure, and agile. It lays the foundation for a new era, where insurers can confidently embrace digital innovations, navigate complexities, and elevate customer experiences to unprecedented heights. In essence, Digital Assurance isn’t just a tool—it’s the compass guiding the insurance industry toward a future marked by excellence and unwavering trust.

How TestingXperts can help you make a difference with Digital Assurance Services in the Insurance Sector?

• TestingXperts tailors’ digital assurance strategies to suit the specific needs of insurance businesses.

• Our suite of services includes functional, performance, security, and usability testing, ensuring a robust digital experience. .

• With automated testing, we significantly reduce testing cycles, enabling insurers to launch digital products faster.

• By ensuring smooth digital interactions, TestingXperts helps insurers improve customer satisfaction and loyalty.

• We rigorously test security measures to safeguard sensitive data, minimizing the risk of cyber threats.

• Our automation-driven approach significantly cuts testing costs while maintaining high-quality standards.

• TestingXperts’ strategies and solutions are designed to scale with your business, adapting to future digital expansions.

• We ensure that all digital solutions adhere to the stringent regulations of the insurance industry.

Discover more

Stay Updated

Subscribe for more info